Providing your business with conventional electricity has become a challenging task due to the constant increase in electricity prices, and it adds a financial cost that can affect your company in different ways. The good news is that, nowadays, businesses can get the most out of sunlight and install commercial solar energy systems. In addition, multiple commercial solar financing options can help you ease the financial impact of electricity rates.

If you want to find out more about solar energy and its advantages, keep reading because in this blog we will show you different options for your business to implement solar power and obtain financial benefits.

Solar energy and businesses working together

An excellent alternative for reducing your business electric bill is to install solar panels, which will transform sunlight into power. But do you know how they work? The first thing that is important to know is that photovoltaic panels are installed on a roof where the sun hits directly, due panels will absorb all the rays of the sun and through an inverter, sunlight will transform into solar energy. Even though not all active solar management systems require battery storage, it is advisable to include one, since it will bring you more benefits along with the new NEM 3.0

You should also consider that paying for solar power for businesses is not the same as doing it for residential purposes, but as we mentioned before, there are a great number of commercial solar financing options that will bring benefits to your business flow of money.

Commercial solar financing option

One of the obstacles that companies face when deciding to go solar is paying for the solar system, however, there are multiple commercial solar financing options for them to choose from. All these programs allow businesses to pay in dribs and drabs until the whole payment is completed and meanwhile, the photovoltaic panels can be used.

Commercial solar loan

A commercial solar loan is a program that helps business owners cover the initial payment of a solar project and there are distinct kinds of loans that come with different types of interest rates or credit, you can choose whatever plan to adjust to your business economy. It is important to mention that this commercial solar financing option is the most suitable for those planning to enroll in the Federal Solar Investment Tax Credit (ITC) since the tax benefits it offers, prevent you from falling into high loan interest rates.

Solar Power Purchase Agreement (PPA)

The Solar Power Purchase Agreement (PPA) allows a third-party developer to own the solar management system, and supervise its operation and maintenance, meanwhile, the host customer provides the location for installing the photovoltaic system, and it will only pay for the solar system owner the price of the electricity used for a set duration. If you decide to go solar with this commercial solar financing option, it is essential to keep in mind that you are paying only for the services produced by the system, and not buying the solar system.

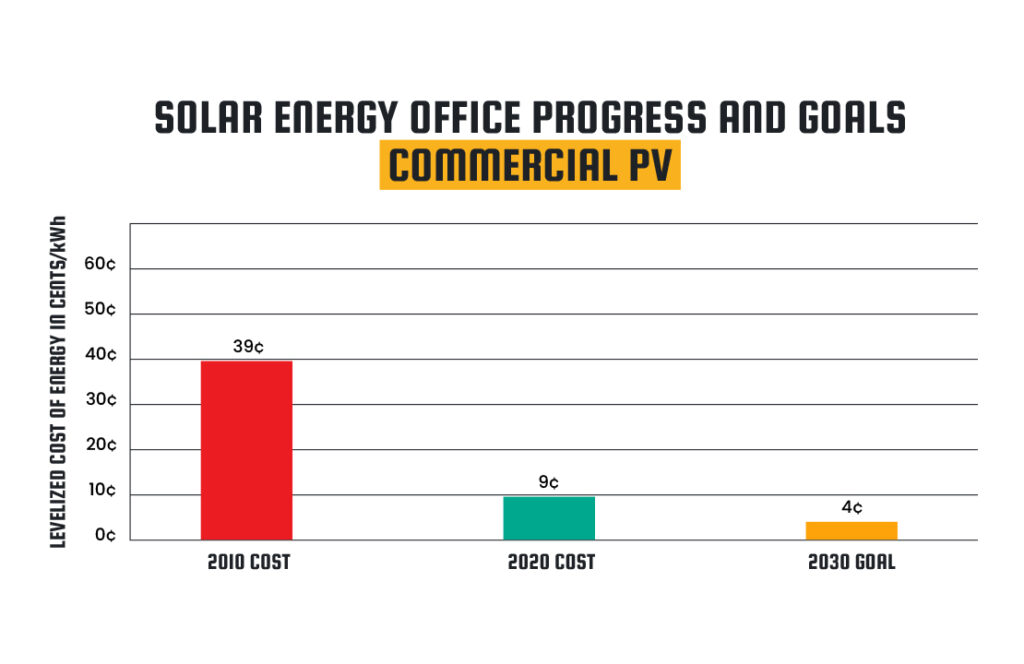

Your business economy can take advantage of the Power Purchase Agreement due to solar power rates are expected to decrease in the following 10 years.

Property Assessed Clean Energy Program (PACE)

Taking care of the well-being of Mother Nature can bring benefits for your company in case you are analyzing if it is a good option to go solar because the government offers a commercial solar financing option called Property Assessed Clean Energy Program (PACE), which pays you back over time the total cost of the up-front solar system through a voluntary assessment, but you must take into account that the PACE is tied to the property, not the business owner.

These initiatives are being developed and launched to encourage more businesses and homeowners in California to choose clean energy projects and make use of renewable energy.

Energy Service Agreement (ESA)

The Energy Service Agreement (ESA) is a commercial solar financing option targeted to business owners who do not have enough money to implement a photovoltaic system. On this program, an ESA provider will pay for the costs of project development and construction, once the project is functioning, the customer will pay monthly a charge set for an existing utility price. You can reach an agreement with your ESA and sign a contract for 5, 10, or 15 years for you to own the solar system at the end of it.

5 tips to choose the best commercial solar financing option

Choosing the best commercial solar financing option is not an easy duty, however, it can be simple if you are sure of what you need, your budget, and other factors that are important to take into account when looking for the best option. To help you to get the greatest option we will give you five tips that you must know if you have decided that your company will go solar.

1. Evaluate your options for solar services

Nowadays, you can find numerous options of solar companies that will offer you the services of photovoltaic panels, nevertheless is crucial to evaluate what benefits you can get from them especially if they have a high-quality commercial solar financing option for your business.

The three elements you need to verify for a solar company to have are:

- 1) It has a license and it’s ensured: This is the main rule a solar company must follow since the proper credentials protect their workers while they are on work time, otherwise, you will have to pay a large amount of money in case one of their workers get hurt while installing your photovoltaic panels.

- 2) It offers you warranties: The information you need to investigate first is what are the warranties you will receive if you go solar with them. Reliable solar companies will offer you warranties if your solar management system stops working or if the system breaks.

- 3) It can provide you with maintenance expertise: Once your solar management system is installed, it will require maintenance, and is better that the experts who installed it can be the ones who fix it. If the solar company you are considering hiring does not offer you maintenance, is preferable to not do it.

2. Learn about tax benefits available in your state

If you wish to save more money than initially expected, is important for you to take into account the existence of tax benefits that usually the government offers for businesses that choose to go solar and give priority to environmental initiatives.

The Federal Tax Credit for Solar Photovoltaics, which is available in California, allows you to claim federal income taxes for a percentage of the cost of a solar photovoltaic system. If you own the solar system and it is installed between January 1, 2017, and December 31, 2034, it is eligible for this tax credit.

3. Calculate the financial benefit your business will receive

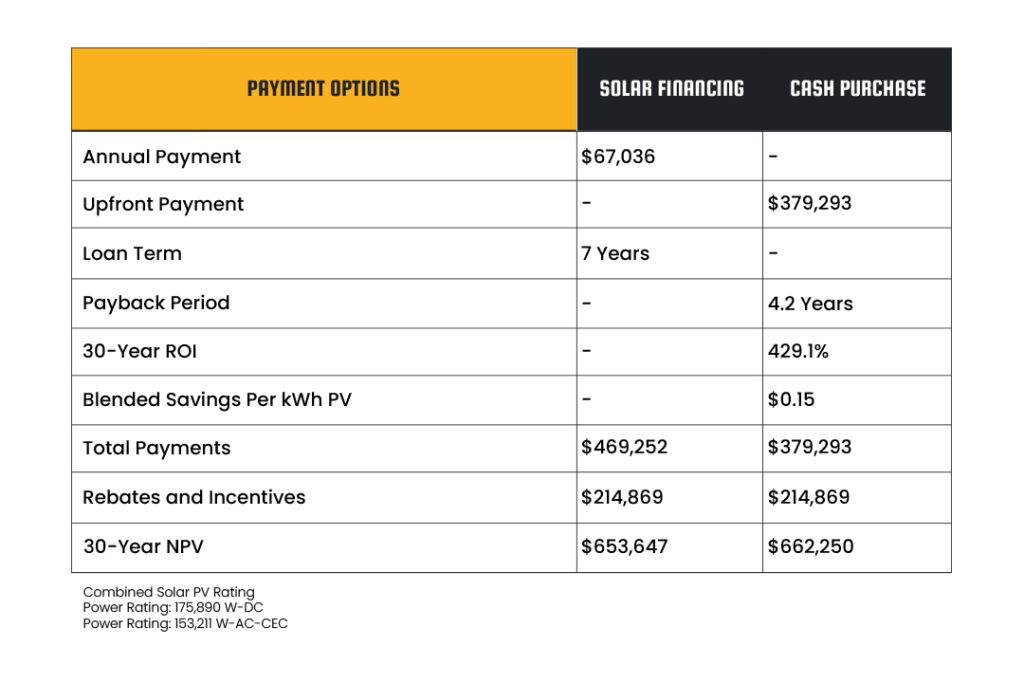

Installing photovoltaic panels in your business through a commercial solar financing option is the best way to save financial resources. The average price of the annual payment, during seven years, for a solar system management is $67,036 versus the cost of purchasing it with cash, which will cost you $379,293. If you add the income you can receive from tax credits and the ROI, it will become evident that the most intelligent method to acquire a solar panel is with a commercial solar financing option.

4. Prepare a plan B for unexpected outages

A great deal of businesses require electricity 24/7 such as supermarkets, hospitals, and industrial facilities, among others. If your business is located in a state where power outages are common, having a plan b for these moments is one of the points you should consider when analyzing if acquire a commercial solar financing option to install a photovoltaic system.

Your solar system can become your best ally for unexpected outages, due to the fact the remaining energy of the day is stored in batteries and if an outage happens, your photovoltaic system will provide you with electricity.

5. Consider benefiting your company from public financial options

A tax credit is not the only alternative for receiving financial benefits from the government, because The California Financing Program offers different types of programs targeted to businesses of any size and field. These schemes will provide you with a loan to make your business grow and therefore you can use the money to pay your commercial solar financing option.

Your best decision is to enroll in a commercial solar financing program

Now that you have learned about the diverse commercial solar financing options and their benefits, it’s time for you to implement a solar system in your business, since nowadays, investing in renewable energy is more than just a final decision, is taking a choice that will beneficiate your business economy and the sustainable future and is for this reason that Solar Symphony offers you options of commercial solar financing programs distinguished by their accessibility.

Give today the first step toward the change! and visit our website to obtain more information about the available commercial solar financing options that Solar Symphony has for your company.